Greek yogurt conquers US market!

Greek yogurt, the thick, creamy, protein-packed dairy product, has stormed supermarket shelves in the United States. The top players of the market have shown a quick growth over the last years. Continuous innovations and extensions of the product lines have contributed to the market growth.

Greek yogurt, the thick, creamy, protein-packed dairy product, has stormed supermarket shelves in the United States. The top players of the market have shown a quick growth over the last years. Continuous innovations and extensions of the product lines have contributed to the market growth.

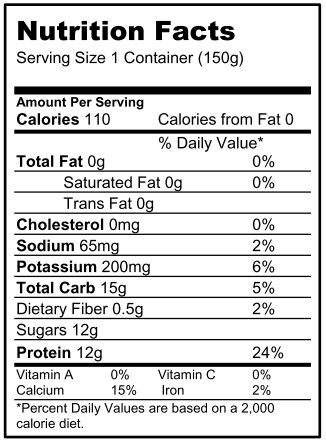

The demand for the Greek yogurt in the US is stems from America’s growing passion for healthy eating. Greek yogurt is considered healthier compared to regular yogurt due to its higher protein content and less sugar and calories. Consumers also find Greek yogurts to be more filling ad nutritious over other alternatives.

US consumers have Greek-style yogurt as a snack in between meals and before workouts. Apart from its nutritional value, it has become popular because of its taste. Greek-style yogurts are offered in many flavors such as mango, blueberry, raspberry, and vanilla.

Greek yogurt’s fast growth as a breakfast alternative is epitomized by widely known companies, which began selling Greek yogurt in 2007 and achieved to see its sales climb sharply from just over $3 million to more than $1.1 billion in the first five years. Today, Greek Yogurt accounts for roughly half of all yogurt sales in the United States, which is remarkable considering that it was essentially irrelevant less than a decade ago.

is epitomized by widely known companies, which began selling Greek yogurt in 2007 and achieved to see its sales climb sharply from just over $3 million to more than $1.1 billion in the first five years. Today, Greek Yogurt accounts for roughly half of all yogurt sales in the United States, which is remarkable considering that it was essentially irrelevant less than a decade ago.

Key facts

Although, Greek yogurt sales ($3.7 billion) fell just short of non-Greek yogurt sales ($4.0 billion) in 2015, the Greek segment is propelling both short- and long-term category growth. According to Nielsen, Greek yogurt sales grew by 4.6% in the latest year while the four-year compound annual growth rate is a great 27.8%. In absolute dollars, Greek yogurt sales grew $2.3 billion in the past four years, while non-Greek yogurt sales declined $843 million, yielding a net gain of $1.47 billion for the category. However, the decline in non-Greek yogurt sales has flattened in the past few years, and in 2015 non-Greek sales actually grew 2.0%.

In terms of wellness-related marketing claims, fat-free/low-fat /reduced fat and gluten-free dominated yogurt sales in 2015, generating $6.3 billion and $3.4 billion, respectively. The next four most common wellness claims (probiotic/prebiotic, protein, fruit and natural) generated sales of $1.2 billion to $1.6 billion.

/reduced fat and gluten-free dominated yogurt sales in 2015, generating $6.3 billion and $3.4 billion, respectively. The next four most common wellness claims (probiotic/prebiotic, protein, fruit and natural) generated sales of $1.2 billion to $1.6 billion.

Of the nine most common wellness claims appearing on the yogurt packaging, only “organic” recorded a negative course (-2,1%) in long-term sales growth. On the other hand, five wellness claims delivered double-digit long-term growth.

These are the following:

- protein (+20.8%)

- reduced sugar (no sugar, less sugar, sugar-free +17%)

- high fructose corn syrup (HFCS) – free (+16.5)

- gluten – free (+13.2%)

- fruit (+12%).

Several of those same claims also saw double-digit short-term dollar growth, including reduced sugar (driven almost exclusively by no sugar added, +184%), HFCS-free (+19.3%) and gluten-free (+10.3%). Natural (+11.8%) and organic (+10%) also complement the list. However, fat claims grew by only 1.8% in 2015, while probiotic/prebiotic (-2.7%), protein (-6.4%) and fruit (-16.3%) claims experienced declines.

With regard to channels, the convenience (+7.4%) and drug (+6.4%) ones registered the strongest yogurt sales growth but accounted for just 1.3% and 0.4% of the total measured retail sales, respectively. More than two-thirds (69%) of yogurt sales reside in the supermarket channel, where sales grew 3.0%, while 29.3% of them are in the value (club, dollar and mass merchandise) channel, where sales expanded by 3.5%.

Youths turn to great fans

According to Technavio, young consumers who account for 40% of the US population, are driving the demand for yogurt and other similar products. This is due not only to their tendency for a healthier lifestyle, but also given the yogurt’s high levels of protein which make it as it a great meal before or after workouts, especially when combined with cereals, nuts and honey.

According to Technavio, young consumers who account for 40% of the US population, are driving the demand for yogurt and other similar products. This is due not only to their tendency for a healthier lifestyle, but also given the yogurt’s high levels of protein which make it as it a great meal before or after workouts, especially when combined with cereals, nuts and honey.

Private label is becoming popular

One of the most influential factors in the overall daily consumption is value for money. People are looking for products that offer more for the amount paid. PL products drove value growth between 2010 – 2015 and continue to gain market share as they value more than branded yogurts. Industry experts argue that branded yogurts will face difficulty in retaining their market shares the following years with the advent of private label brands.

An alternative to prepare dishes

Due to the texture, vitamins, and the minerals it provides, consumers buy Greek yogurts as a substitute for all kinds of dairy products. It is also a substitute for dips, such as sour cream, buttermilk, ketchup, etc., and it can be used in baking as well. Many vendors are promoting Greek yogurt for cooking purposes. For example, it can be used as a substitute for vitamin B12, which helps in healthy functioning of the brain. Due to its rich texture it is rapidly substituting other fatty ingredients like butter, oil, mayonnaise, etc.

the minerals it provides, consumers buy Greek yogurts as a substitute for all kinds of dairy products. It is also a substitute for dips, such as sour cream, buttermilk, ketchup, etc., and it can be used in baking as well. Many vendors are promoting Greek yogurt for cooking purposes. For example, it can be used as a substitute for vitamin B12, which helps in healthy functioning of the brain. Due to its rich texture it is rapidly substituting other fatty ingredients like butter, oil, mayonnaise, etc.

What the future holds in store for the Greek yogurt

According to a new market report published by Transparency Market Research, the North America yogurt market was valued at $11.18 billion in 2015 and is expected to reach $14.59 billion by 2024, growing at a CAGR of 3 percent from 2016 to 2024. The introduction of new flavors, novel packaging and new technologies will prove catalytic in increasing the demand for Greek yogurts the following years.

This article was exclusively written by DK Consultants for the AMCHAM newsletter.