E-commerce is on the rise!

E-commerce is increasingly becoming a popular retail sales and transactions channel in a world where consumers constantly use multiple devices for online shopping. Online sales are growing much faster than in-store sales, which suggests that e-commerce remains a major growth driver in the retail industry as a whole. In 2017, total e-commerce online sales are expected to reach €265.68 bn, a rise of 14.2% and €302.37 bn (+ 13.8%) in 2018.

E-commerce is the fastest growing retail market in Europe and North America, achieving in Europe growth rates of 18.2% (in 2015), 15.6% (2016), and expected increases of 14.2% and 13.8% in 2017 and 2018 respectively. In contrast, the annual growth rates for all types of retailing (from stores to online) have ranged between 1.5% and 3.5% p.a. on average.

E-commerce is the fastest growing retail market in Europe and North America, achieving in Europe growth rates of 18.2% (in 2015), 15.6% (2016), and expected increases of 14.2% and 13.8% in 2017 and 2018 respectively. In contrast, the annual growth rates for all types of retailing (from stores to online) have ranged between 1.5% and 3.5% p.a. on average.

In particular,

- The US online share of retail (i.e. sales of goods) was 12.7% in 2015, 13.9% in 2016, and is expected to be 14.8% in 2017. In comparison, the European online market share was

7.0% in 2015, 8.0% in 2016, and 8.8% in 2017.

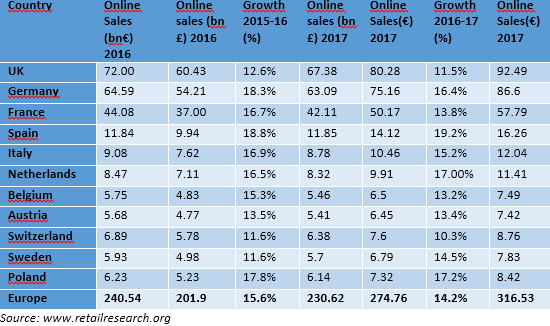

7.0% in 2015, 8.0% in 2016, and 8.8% in 2017. - The European countries with the highest online shares of their internal markets are the UK (16.8% in 2016 and 17.8% in 2017), Germany (15.1% for 2017) and France (a 10.0% forecast for 2017). Other countries with high market shares are Sweden and the Netherlands. Germany has had the fastest-growing online sector for the last few years, but the forecast for 2017 is a mere growth of 16.4% compared to Spain’s (+19.2%), Poland’s (17.2%) and the Netherlands’ (17.0%).

- The UK, Germany and France are responsible for approximately 181.6 bn online sales, which account for 75.1% of European online sales.

- Online sales in Western Europe and Poland grew from €201.33 bn in 2015 to €232.60 bn in 2016 (+15.6%)

- In the US, total e-commerce sales for 2016 were estimated at $394.9 billion, an increase of 15.1% (±1.8%) from 2015, while total retail sales in 2016 increased by 2.9 %

(±0.5%) compared 2015. E-commerce sales in 2016 accounted for 8.1% of the total sales, compared to 2015 where they represented 7.3% percent of total sales. In 2017, US online sales are about to reach $459.07 bn (+14.9%) and grow to $529.76 bn in 2018 (+15.4%).

(±0.5%) compared 2015. E-commerce sales in 2016 accounted for 8.1% of the total sales, compared to 2015 where they represented 7.3% percent of total sales. In 2017, US online sales are about to reach $459.07 bn (+14.9%) and grow to $529.76 bn in 2018 (+15.4%). - 208 mn (66.0%) of the US population were e-shoppers compared to 219 mn (52.8%) in Europe in 2016. Every online shopper in Europe spent on average $1,194.77 (€1,062.02) in 2016 compared to $1,915.23 (€1,702.43) in the US.

- Canada’s online sector is now starting to develop rapidly, boosted by the depreciating Can$. It is expected to grow by 22.6% in 2017, from US$12.69 bn in 2016 to $19.97 bn in 2017.

The recession induced many shoppers to buy online instead of visiting stores. The fact that internet search is comparatively easy and predictable has made online retailing attractive for a wide range of products. Moreover, the growing use of mobile technology is an additional factor that made online retailing more attractive and convenient.

The recession induced many shoppers to buy online instead of visiting stores. The fact that internet search is comparatively easy and predictable has made online retailing attractive for a wide range of products. Moreover, the growing use of mobile technology is an additional factor that made online retailing more attractive and convenient.

Many retailers already report that up to 70%-80% of website browsing occurs through customers using mobile devices, both smartphones and tablets. In 2016, actual spending via mobiles (both tablets and smartphones) was 23.4% in Europe compared to 33.9% in the U.S. Individual European countries had higher rates, such as the UK (35.6%), Germany (34.0%) and Sweden (29.6%). However, the major growth in online sales is likely to be the result of higher sales via mobiles (+89.2% expected in Europe during 2015-2017) with only 14.5% of online growth being made using PCs and laptops.

In addition, according to a new study published by the Pew Research Center, nearly 80% of Americans do at least some shopping on the internet, with 43% of those shopping online on a weekly basis or a few times per month.

Americans do at least some shopping on the internet, with 43% of those shopping online on a weekly basis or a few times per month.

Mobile devices continue to gain popularity for buying products online, since consumers can purchase products on-the-go, and do not need to visit a retailer during certain opening hours.

Therefore, it comes as no surprise that conventional retailer profits are falling as fewer shoppers head to the malls in favor of the click-and-buy option offered by Amazon and a trove of emerging online fashion vendors.

In particular, the total value of U.S. consumers’ transactions on Amazon.com reached $147.0 billion in 2016, a 31.3% increase compared to $112.0 billion in 2015. Amazon’s growth in 2016 was driven by sales in the electronics, home, and apparel categories.

In particular, the total value of U.S. consumers’ transactions on Amazon.com reached $147.0 billion in 2016, a 31.3% increase compared to $112.0 billion in 2015. Amazon’s growth in 2016 was driven by sales in the electronics, home, and apparel categories.

Main e-commerce trends

Overall, modern buyers expect a strong mobile experience. Consumers are now ever-connected and always plugged in, with instant access to billions of websites and products at the tap of a screen. Taking into consideration the increased connectivity of the purchasers, many store-based retailers focus on internet retailing or strengthening their online presence. As a result, retailers are increasingly supporting their internet strategies with mobile apps that can be used to compare prices, receive discounts and check order status, amongst other benefits. Consistency across all touch points and easy to use, be it mobile, tablet or desktop are therefore a must.

This article was exclusively written by DK Consultants for the AMCHAM newsletter.

Sources: www.retailresearch.org, www.businesstimes.com.sg, www.euromonitor.com, www.digitalcommerce360.com, www.businessinsider.com, www.usnews.com, www.pewinternet.org, Criteo (State of Mobile Commerce Report, Q3 2015), US Census Bureau News (February 2017).