USA: A NATION OF WINE LOVERS

In 2013, the U.S. became the number-one wine-consuming nation in the world for the first time ever, surpassing France which is considered the natural home of good wines. In particular, US consumers bought 29.1 million hectoliters of wine in 2013, an increase of 0.5% in comparison to the 2012 levels, while French consumption fell nearly 7% to 28.1 million hectoliters (mhl).

With 31 million mh in 2015, the United States remain the leading wine consumer globally, while consumption was relatively stable in Italy (20.5mh) and Spain (10 mh), yet continued to erode in France (27.2 mh). However, per capita consumption in the US remains low (10.25 liters in 2015) in comparison to Europe where it remained between 2011 and 2015, at 24-25 liters per person. Nevertheless, a longer-term trend shows that wine consumption per capita is slightly decreasing in the European continent. This is due to changing lifestyles and tastes, anti-alcohol drinking campaigns and health concerns. In particular, in wine producing countries such as France, Italy and Spain, people drink less wine by volume, but more quality wine, while in the US they have a tendency to consume more and more wine and particularly quality wine.

Trends in wine consumption in the US

Trends in wine consumption in the US

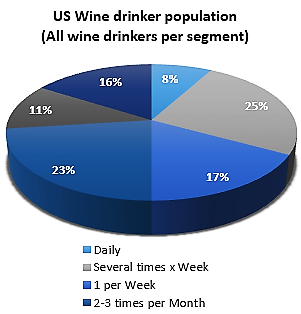

-It is estimated that 40% of US adults drink wine. 33% of those adults drink wine several times per week and 67% drink wine occasionally. Although women account for nearly 60% of sales among occasional wine drinkers, there is an equal male-female division among high frequency wine consumers.

-It is estimated that 40% of US adults drink wine. 33% of those adults drink wine several times per week and 67% drink wine occasionally. Although women account for nearly 60% of sales among occasional wine drinkers, there is an equal male-female division among high frequency wine consumers.

-The Boomers (born between 1946-1964) lead sales in the fine wine category, followed by the Gen X (born between 1965 to 1976).

-As the largest demographic segment in the US, millennials (born between 1977 to 1995) are  reaching legal drinking age and now account for about a third of the consumers over 21 years of age. Therefore, they are rapidly becoming the largest generational segment of high-frequency wine drinkers, and in a decade they will be the largest generational consumers of fine wine. These soon-to-be greatest consumers of wine in the US seek new and more upscale offerings as well as more adventurous and authentic tastes.

reaching legal drinking age and now account for about a third of the consumers over 21 years of age. Therefore, they are rapidly becoming the largest generational segment of high-frequency wine drinkers, and in a decade they will be the largest generational consumers of fine wine. These soon-to-be greatest consumers of wine in the US seek new and more upscale offerings as well as more adventurous and authentic tastes.

-More than 60% of US wine market volume growth is coming from wines priced between $9 and $15.

-US is now clearly positioned as the most attractive major market for premium wines.

*Wine sales have increased in the $12 – $30 range and are expected to continue with the strong dollar, lower oil prices, and desire for more premium products

* Sparkling wines -especially Prosecco- are “hot”. Nielsen figures released in October 2015 showed that sparkling wines overall were up 10% in value over the previous year, and up 8% by volume. Sparkling wines represent a 5-5,5% share of the U.S. wine market. Sparkling wines constitute a lighter alternative to the spirits before the consumption of a meal.

Sparkling wines -especially Prosecco- are “hot”. Nielsen figures released in October 2015 showed that sparkling wines overall were up 10% in value over the previous year, and up 8% by volume. Sparkling wines represent a 5-5,5% share of the U.S. wine market. Sparkling wines constitute a lighter alternative to the spirits before the consumption of a meal.

*Red Blends are the fastest-growing wine segment product, accounting for almost 41% of new  wine entrants in the US market in recent years. According to Nielsen, red blends generated value growth of 8.7% and volume growth of 3.2% for the year ending 12 September 2015, indicating that consumers buy more red blends, but at more premium price points as well.

wine entrants in the US market in recent years. According to Nielsen, red blends generated value growth of 8.7% and volume growth of 3.2% for the year ending 12 September 2015, indicating that consumers buy more red blends, but at more premium price points as well.

*Rose wines over $12 performed well in 2014 with dry rose wines becoming more and more popular among the Millennials.

-Natural and “Eco” Wines: Given that consumers are more health conscious and environmentally aware, they tend to look for the right wines. 16% of US wine consumers are now looking for eco labels on the wine.

-Wine Apps are growing in popularity with up to 36% of US consumers using them to check prices and reviews before purchase

Sources: International Organization of Vine and Wine (OIV, 2016, 2015), Business France (2016,), Wine Market Council (2014), Wine Business Monthly (January 2016), Shanken News Daily (2015, 2014), Wine Spectator (2013, 2014), CBI (2016), www.meininger.de, www.vino-california.com, www.thedrinksbusiness.com, www.wineinstitute.org, Per and Britt Karlsson (2016), Dr. Liz Thach (2015), DK Business Analysis Unit.